Knoxville Bankruptcy Chapter 7 Means Test Numbers Change Hurts Most People

- Posted by Dan

- On

- 0 Comments

- "Chapter 13", Chapter 7, knoxville bankruptcy, means test

Justice Department Publishes New Means Test Numbers

At the request of the Credit Card Industry Lobbyists, Congress enacted the Bankruptcy Abuse Prevention and Consumer Protection Act effective in October 2005. Since then, if you file a Knoxville bankruptcy when your debts are primarily consumer debts you must go through what is known as the “means test.” The Means Test is intentionally designed to make it harder for people to file Chapter 7 bankruptcy.

If you are above the “median income” then in many cases you must file a Chapter 13 bankruptcy. However it’s important to know that even if you are above the median income, you may be entitled to specific deductions from your income which may still allow you to file a Chapter 7 bankruptcy.

Because the banks and credit card companies claimed that people were abusing the bankruptcy system by discharging their unsecured debts even though they could make the regular payments Congress passed the requirement of the Means Test.

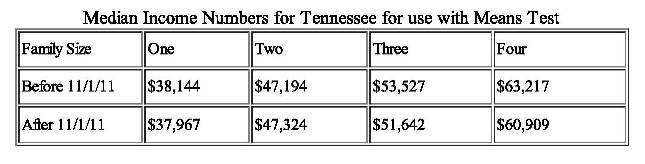

For folks filing bankruptcy in Knoxville it’s important to know that the Means Test changes a couple of times each year. The Federal Government establishes the new numbers which will be effective November 1. This year the new numbers will hurt families that are attempting tofile Chapter 7 bankruptcy in Knoxville because in almost every category the “median income” is being lowered. Remember that is you are above the “median income” when your income is averaged for the last 6 months then you must move on to the second phase of the Means Test to determine if you can file a Chapter 7.

A comparison of the before and after November 1 median income numbers should be helpful.

As you can see, if you are filing bankruptcy in Knoxville it will become harder to file a Chapter 7 case for many families. This holds true if you live in Maryville, Sevierville, Pigeon Forge, Gatlinburg, Dandridge or Jefferson City. We help families in all those cities tackle their debt problems by evaluating whether a Chapter 7 Bankruptcy or a Chapter 13 Bankruptcy is the best solution. Often we recommend a Chapter 13 in order to help families save their home from foreclosure.

Obviously, the means test is just one aspect that must be considered in determining whether to file Chapter 7 Bankruptcy. It’s easy to know and understand your options if you consult with an experienced Knoxville – Sevierville bankruptcy attorney. We offer a free consultation so that you can know your rights and how to protect your family.

Call Knoxville – Sevierville Bankrutpcy Attorneys Today.

You are one call away for getting advice from a bankruptcy attorney with over 25 years of experience in filing bankruptcies. Call TODAY at 865-246-1050.

0 Comments